Deferred Income Double Entry

Past simple and past participle of defer 3. The balance on the deferred tax liability account is 150 representing the future liability of the business to pay tax on the income for the period.

Accrued And Deferred Income All You Need To Know First Intuition Fi Hub

If the tax rate is 30 the Company will make a deferred tax asset journal entry Deferred Tax Asset Journal Entry The excess tax paid is known as deferred tax asset and its journal entry is created when there is a difference between taxable income and accounting income.

. The double entry bookkeeping for membership dues paid in advance is similar to other forms of income. The income tax payable account has a balance of 1850 representing the current tax payable to the tax authorities. Past simple and past participle of defer 2.

For example if a member pays an annual membership renewal of 1200 in cash then the bookkeeping entry would as follows. The credit to the deferred membership income account represents a liability as the. The effect of accounting for the deferred tax liability is to apply the matching principle to the financial.

Current Tax Expense Dr. The journal entry for deferred tax asset is.

Accrued And Deferred Income All You Need To Know First Intuition Fi Hub

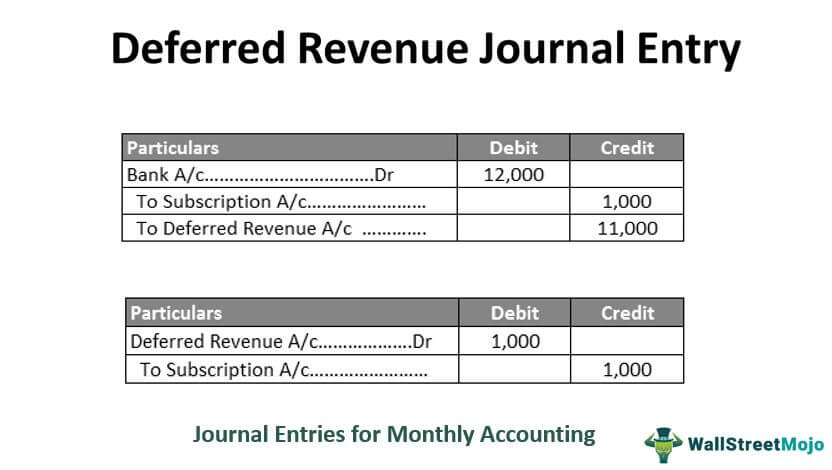

Deferred Revenue Journal Entry Step By Step Top 7 Examples

Deferred Revenue Journal Entry Double Entry Bookkeeping

Service Revenue Archives Double Entry Bookkeeping

0 Response to "Deferred Income Double Entry"

Post a Comment